When you decide to sell your home in Ireland, the advertised sale price is only part of the story. Many homeowners are caught off guard by the various fees, taxes and expenses that come out of their final proceeds.

Whether you’re selling a family home in Kildare, an investment property in Dublin or downsizing in Maynooth, understanding these costs upfront helps you plan effectively and avoid unwelcome surprises at closing.

This guide breaks down every expense you’re likely to encounter when selling property in Ireland in 2025, helping you calculate your true net proceeds and make informed decisions about your sale.

The Main Costs of selling a House in Ireland, including estate agent charges and professional fees.

Estate Agent Fees and Commission

Estate agent fees typically represent one of the largest costs when selling property in Ireland. Most agents charge a percentage-based commission on the final sale price, though flat-fee and hybrid models are also available for property services.

Commission rates in Ireland generally range from 1% to 2% plus VAT for residential properties. In competitive markets like Dublin, Kildare and Meath, you’ll usually find rates at the lower end of this scale. Rural areas may see slightly higher percentages in property services due to longer selling times and smaller transaction values.

For example, on a €400,000 home with a 1.5% commission rate, you would pay €6,000 plus VAT, which works out to €7,380 total in estate agent charges. This fee covers professional photography, property marketing across major portals, viewings, negotiations, and transaction management through to completion of the sale of a house.

Working with an experienced local agent often results in quicker sales and better prices, offsetting their commission through added value and reduced stress throughout the selling process. Your agent should provide accurate property valuations based on local market data, high-quality photography and floor plans, listings on Daft.ie and MyHome.ie, accompanied viewings with qualified buyers, expert negotiation to maximise your sale price, and full coordination with solicitors and mortgage providers.

Legal fees for selling a house and Solicitor Costs

Every property sale in Ireland requires a solicitor to handle the legal transfer of ownership. Legal fees typically range from €1,500 to €3,000 plus VAT and disbursements, depending on your property’s complexity and location.

Your solicitor manages all legal aspects of the transaction, including title investigation, drafting contracts of sale, liaising with the buyer’s solicitor, handling mortgage discharge if applicable, completing Land Registry paperwork and transferring funds securely on closing day.

Additional costs may apply for leasehold properties, new builds with complex developer agreements, or properties with boundary disputes or planning permission issues.

Select a solicitor with specific experience in residential conveyancing in your area to help navigate the fees for selling a house. They should be familiar with local authority requirements and able to respond quickly to queries. Many estate agents can recommend trusted legal professionals who understand the Irish property market inside out.

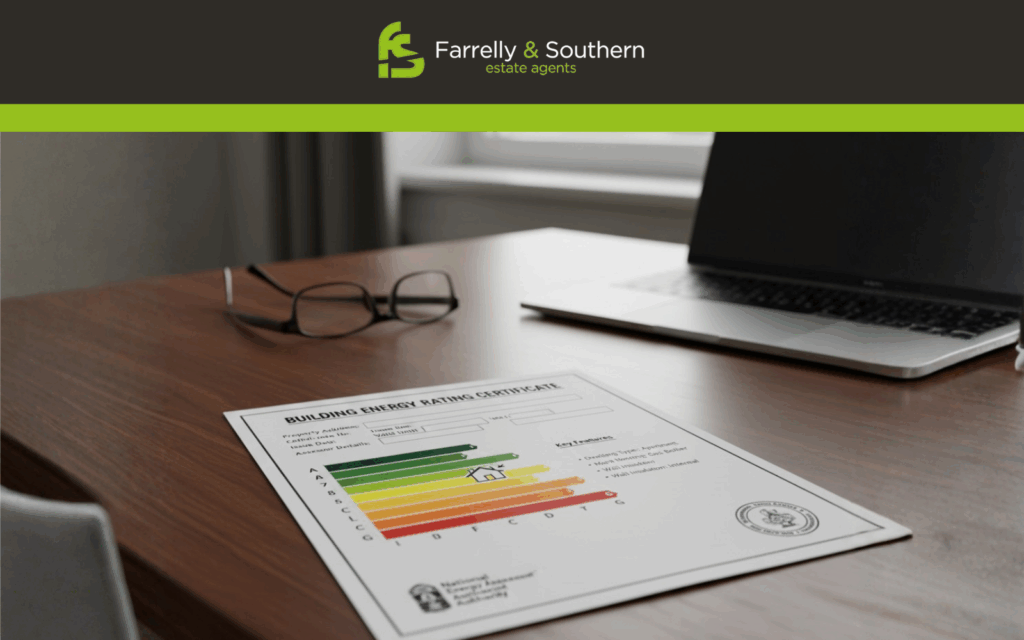

Building Energy Rating Certificate

Since 2009, it’s been a legal requirement to have a valid BER certificate before advertising any property for sale in Ireland. This certificate rates your home’s energy efficiency from A (most efficient) to G (least efficient), which can influence your decision to sell your property.

A BER assessment typically costs between €150 and €300, depending on your property’s size and location. The certificate remains valid for ten years, so if your home already has a current BER, you won’t need a new one.

The assessor will evaluate insulation, heating systems, windows, renewable energy installations, and other potential costs associated with the house sale. While you’re not required to make improvements before selling, a better rating can increase your property’s appeal and value, particularly as energy costs remain high across Ireland.

Research shows that homes with A or B ratings command premium prices, while properties with poor ratings may sell for less or take longer to attract buyers. If your home has a low rating, consider whether modest improvements before selling could improve both your BER score and final sale price.

Property Advertising and Marketing Costs

While estate agent commissions typically cover standard marketing, additional promotional expenses may arise depending on your sales strategy.

Most estate agents include professional photography, online listings on major Irish property portals, printed brochures, for-sale signage, and social media promotion as part of their service package, all of which contribute to the fees for selling.

For higher-value properties or competitive markets, you might consider drone photography and videography costing €300 to €800, virtual 3D tours and floor plans at €200 to €500, premium placement on property websites for €150 to €400, or targeted social media advertising campaigns ranging from €200 to €1,000.

These investments can help your property stand out in busy markets, potentially leading to quicker sales and stronger offers.

Capital Gains Tax on Property Sales

For most homeowners selling their primary residence, Capital Gains Tax does not apply due to Principal Private Residence Relief, making it easier to sell your property. However, CGT may be relevant if you’re selling an investment property, second home, or inherited property, which are significant considerations in the costs involved.

CGT is charged at 33% on the gain between your purchase price and sale price, after accounting for allowable expenses like improvement costs and selling expenses, including estate agent charges. If you inherited the property, the gain is calculated from the market value at inheritance rather than the original purchase price.

Principal Private Residence Relief eliminates CGT on your main home, provided you lived there throughout your ownership, which is crucial during the sale process. Partial relief may apply if you rented it out for part of your ownership period, impacting your property tax. Consult with your tax adviser or accountant to ensure you claim all available reliefs and accurately calculate any CGT liability related to the sale of a house.

Additional Costs to Consider When Selling

Mortgage Redemption and Early Repayment Fees

If you’re selling before your mortgage term ends, you may face early redemption charges from your lender. These fees compensate banks for lost interest and can range from one to six months’ interest, depending on your mortgage type and remaining term, which are important costs involved in selling a property.

Properties on fixed-rate deals typically incur higher redemption penalties, which can affect the price for your property. Review your mortgage agreement or contact your lender for exact figures well before accepting an offer, as these costs can be substantial in the sale process.

Variable or tracker mortgages generally have lower or no early redemption fees, making them more flexible if you’re planning to sell. Some lenders waive redemption fees if you’re taking out a new mortgage with them for your next property.

Home Repairs and Preparation Costs

Most Irish homes benefit from some preparation before going to market. While you’re not required to make repairs, addressing obvious issues helps your property show better and can prevent price negotiations later, thereby facilitating the sale process.

Typical preparation costs include professional cleaning and decluttering at €150 to €400, minor repairs like fixing leaky taps or patching walls for €200 to €800, fresh paint in neutral colours costing €500 to €2,000 depending on your home’s size, and garden tidying and kerb appeal improvements at €200 to €1,000.

Properties in excellent condition typically sell faster and achieve better prices, making modest investments in presentation worthwhile for most sellers.

How to Minimise Selling Costs in Ireland

Choosing the Right Estate Agent

Not all agents offer the same value proposition. When comparing estate agents, look beyond commission rates to consider their track record in your area, average selling prices achieved versus asking prices, typical time on market for properties they list, quality of marketing materials and online presence, and communication style and availability.

Experienced local agents understand regional market dynamics and can often achieve higher sale prices that more than offset their commission through expert negotiation and targeted marketing to qualified buyers.

Timing Your Sale Strategically

Property markets in Ireland follow seasonal patterns that can influence the price of your property. Spring months from March to May typically see the highest buyer activity and strongest prices, as families aim to move before the new school year. Early autumn, from September to October, represents another strong period for those looking to sell a property in Ireland as the summer holiday season ends.

Selling during peak seasons may result in more viewings, competitive bidding and faster sales, reducing holding costs like mortgage payments and utility bills while your property is on the market.

Real-World Example: Total Cost Breakdown

To illustrate how selling costs add up, let’s examine a typical scenario for a property in Kildare, considering potential costs like estate agent charges and legal fees.

Sale price of €400,000 for a four-bedroom semi-detached home with a mortgage balance of €180,000 on a fixed-rate mortgage with two years remaining.

Estate agent commission at 1.5% plus VAT amounts to €7,380, which is part of the professional fees for selling a house. Solicitor fees, including VAT and disbursements, total €2,500, contributing to the overall costs when selling a house. A BER certificate costs €200. Pre-sale improvements, including painting and minor repairs, come to €1,500. Mortgage early redemption fee equals three months’ interest at €1,800, an important consideration when you decide to sell your property. Property marketing extras, including premium photography, add €600.

The total selling costs reach €13,980, representing approximately 3.5% of the sale price. After deducting these costs and the mortgage balance of €180,000, the seller’s net proceeds would be €206,020 from the €400,000 sale.

This example demonstrates why understanding all costs is crucial for accurate financial planning, especially if you’re using proceeds as a deposit for your next home.

Planning Your Property Sale Budget

Ready to Sell or Let Your Property?

Expert estate agents serving Kildare, Meath & Dublin

In a market obsessed with numbers, we obsess about the success of our clients

Visit Our Office

Farrelly & Southern Estate Agents

Suva House, Main Street

Maynooth, Co. Kildare

W23 D8P5

We specialise in sales, lettings, property management and valuations with a personalised approach that puts your success first.

Selling a house in Ireland involves multiple costs beyond the estate agent’s commission. By understanding and budgeting for legal fees, BER certificates, mortgage redemption charges, and preparation expenses, you can accurately calculate your net proceeds from the sale of a house and avoid financial surprises.

The total cost typically ranges from 3% to 5% of your sale price, though individual circumstances vary based on your mortgage situation, property condition and chosen service levels.

Working with experienced professionals who understand the Irish property market helps ensure smooth transactions and often results in better final prices that offset their fees through expert marketing and negotiation.